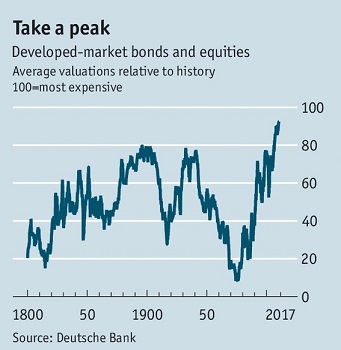

But for those new to considering your investments, please understand we are near the end of a very long cycle. Not the business cycle or stock market cycle or even the earnings cycle, but a global credit cycle. We are reaching peak everything because of it. That's over 200 years...

Does this mean sell everything today? No. It just means past performance really should not be used to assume similar future returns. When your standing well within the top 1% and maybe the top of all historical financial asset valuations, past returns will never look better.

Much of what worked in the past will not work sometime soon in the future.

As for seasonal investing, I believe the seasonal influences are always there and they will continue to beat buy & hold over the long term. I expect SP500 to be no higher than today 12 years from now barring high inflation. I expect seasonal strategies to beat this by a couple of percent annually depending on the strategy and fund.

I also believe over the short term other factors can overwhelm the seasonal currents. Missing the next bear market would allow you to achieve higher returns over the next 12 years.

The Fed chair said this week that while valuations are high, they may not be over-valued because we are in a low interest rate environment. She failed to mention the central banks have manipulated interest rates lower than free-markets would have allowed and they are now trying to figure out how to unscrew the markets.

I discussed her premise in my post "Not Overvalued"

I know there are many different views on the market and how to play it. I just want newbies and others to understand that at some point market valuations will matter again.