Finding the number, WAG or SWAG

Moderator: Aitrus

- Scarfinger

- Posts: 811

- Joined: Mon Jan 30, 2012 12:00 am

Finding the number, WAG or SWAG

Finding the number... WAG or SWAG

I threw out a WAG (wild as guess) and Aitrus suggested it should be more of a SWAG (scientific wild ass guess). I am going to try and nail this down a bit.

General assumptions are that you will only need around 80% of your annual income in retirement. So, lets nail this one down first.

Current annual income: Primary federal job: 65,505 a year.

Second per-diem job: 8,000 to 12,000 a year. I will compromise and use 10,000 for my per-diem work.

This is current salary and I plan on working for another 9 years. Using a “salary increase calculator” and a low estimate of annual raises of 1% ($71000) to 2% ($78000) by year 9. Splitting the baby and calling it $74,500. I am using only 1% to 2% considering I will be step 10 in 2 years which will be around a 2.5% raise and hoping the 1% to 2% will be at least a cost-of-living type increase. I will keep my per-diem at 10,000. *This calculation will probably need updated a few times before retirement.

$74,500 + $10,000 ($84,500) annual income at retirement

General rule of thumb is that you will need 80% of pre-retirement income. That is $67,600 for me.

Quick estimate to see if 80% is close to what I can live on:

$74,500 – 20% that I put in TSP = $59,600 + 10K per-diem = $69,600 (not good, need more money!)

But... My house will be paid off saving me another $4,800 a year. $69,600 – $4,800 = $64,800

I looks like I only need 64,800 in retirement. To be safe... lets compromise and use $66,200 needed in retirement. (67600 + 64800) /2 = $66,200.

For me the 66,200 includes money for savings and or unexpected expenses like a new furnace which is what I use the per-diem money from my second job for. I am currently making a car payment so that is also included.

How much TSP money will I need...

FERS Pension: 26 years x .011 x $70,000 = $20,020 year

Second Pension: $9,600 year

SS of $31,200 year (age 66 and 10 months)

$66,200 - (9600 + 20020 + 31200) = $5,380 needed from TSP per year.

$5380 / .04 = 134,500 needed in TSP minimum? (who wants minimum? Not me)

Running Portfolio visualizer with historical inflation on a 60/40 portfolio x30 years = 90% success rate.

My estimated finally TSP balance using 2% to 6% annual returns will be $400,000 to $600,00.

Portfolio Visualizer: using historical inflation on a 60/40 portfolio and withdrawing 1000 a month x30 years with a 400,000 TSP = 100% success rate. (yeah me, looking good) I will have fun money/buffer money, all good.

Is this WAG or SWAG?

I threw out a WAG (wild as guess) and Aitrus suggested it should be more of a SWAG (scientific wild ass guess). I am going to try and nail this down a bit.

General assumptions are that you will only need around 80% of your annual income in retirement. So, lets nail this one down first.

Current annual income: Primary federal job: 65,505 a year.

Second per-diem job: 8,000 to 12,000 a year. I will compromise and use 10,000 for my per-diem work.

This is current salary and I plan on working for another 9 years. Using a “salary increase calculator” and a low estimate of annual raises of 1% ($71000) to 2% ($78000) by year 9. Splitting the baby and calling it $74,500. I am using only 1% to 2% considering I will be step 10 in 2 years which will be around a 2.5% raise and hoping the 1% to 2% will be at least a cost-of-living type increase. I will keep my per-diem at 10,000. *This calculation will probably need updated a few times before retirement.

$74,500 + $10,000 ($84,500) annual income at retirement

General rule of thumb is that you will need 80% of pre-retirement income. That is $67,600 for me.

Quick estimate to see if 80% is close to what I can live on:

$74,500 – 20% that I put in TSP = $59,600 + 10K per-diem = $69,600 (not good, need more money!)

But... My house will be paid off saving me another $4,800 a year. $69,600 – $4,800 = $64,800

I looks like I only need 64,800 in retirement. To be safe... lets compromise and use $66,200 needed in retirement. (67600 + 64800) /2 = $66,200.

For me the 66,200 includes money for savings and or unexpected expenses like a new furnace which is what I use the per-diem money from my second job for. I am currently making a car payment so that is also included.

How much TSP money will I need...

FERS Pension: 26 years x .011 x $70,000 = $20,020 year

Second Pension: $9,600 year

SS of $31,200 year (age 66 and 10 months)

$66,200 - (9600 + 20020 + 31200) = $5,380 needed from TSP per year.

$5380 / .04 = 134,500 needed in TSP minimum? (who wants minimum? Not me)

Running Portfolio visualizer with historical inflation on a 60/40 portfolio x30 years = 90% success rate.

My estimated finally TSP balance using 2% to 6% annual returns will be $400,000 to $600,00.

Portfolio Visualizer: using historical inflation on a 60/40 portfolio and withdrawing 1000 a month x30 years with a 400,000 TSP = 100% success rate. (yeah me, looking good) I will have fun money/buffer money, all good.

Is this WAG or SWAG?

I am just an average Joe. I have no clue to what the market will do.

Paul Merriman 2 fund strat: (age - 25) x2.5 = TDF + balance into S fund or variation ofTimboSlice wrote: "People really need to stop overthinking this."

Re: Finding the number, WAG or SWAG

It's SWAG--since you quantified your *known* factors. You didn't factor in other factors like health issues/accidents, inheritance, job loss, pensions getting cut, the apocalypse happening and so on, that could have significant impact on your final tally at retirement moving forward.

Regardless , the analogy is that is if you fired a shotgun a yard (year) out at a target your aim is gonna be spot on but if you'd shot 9 yards (years) away you're probably gonna miss by a wide margin no matter how fastidious you were taking aim (crunching the numbers).

The key is to make it a point to REVISIT THEN UPDATE your spreadsheet annually for the next 8 years. That way you'll maintain some degree of accuracy.

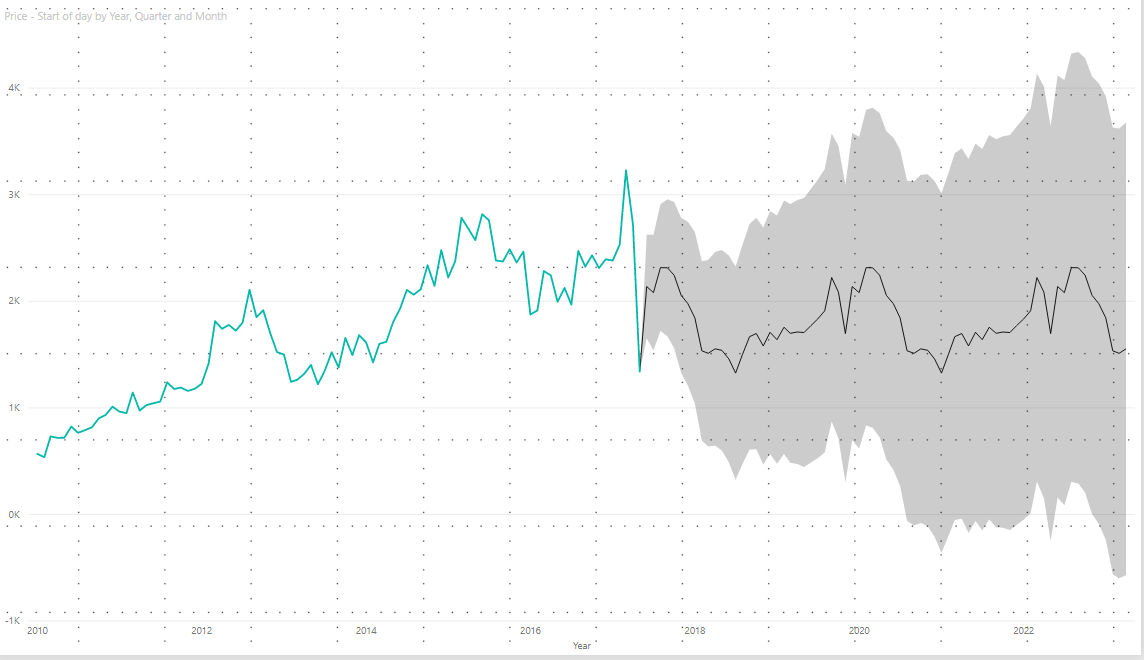

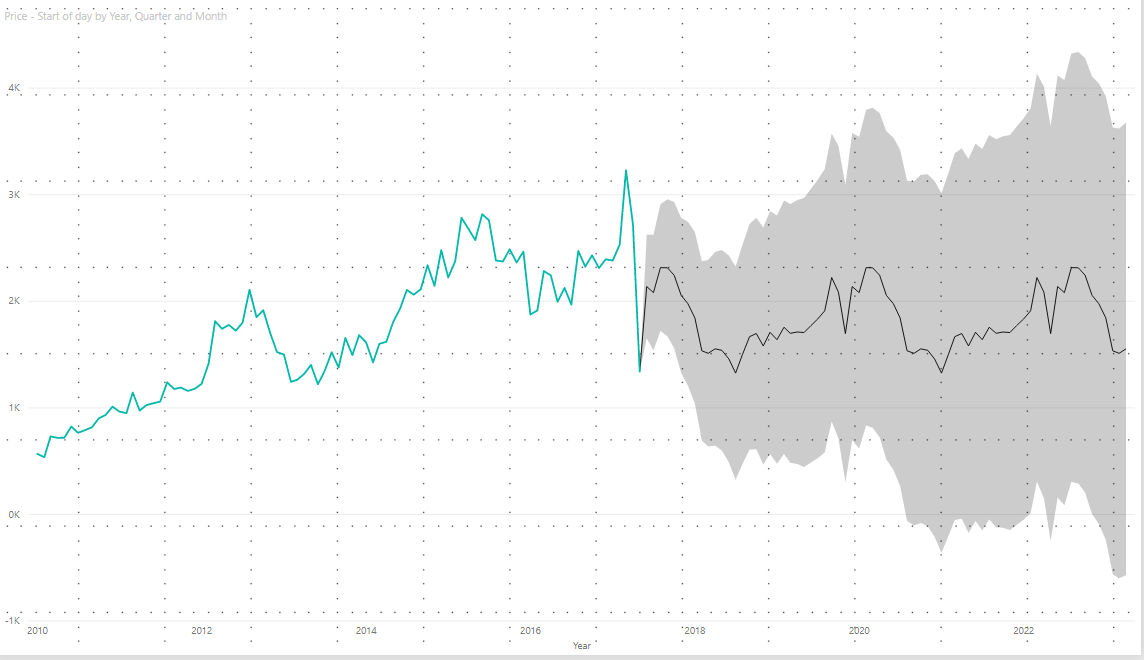

Below is a time series chart that illustrates how quantified forecasts inherently become inaccurate over time:

Regardless , the analogy is that is if you fired a shotgun a yard (year) out at a target your aim is gonna be spot on but if you'd shot 9 yards (years) away you're probably gonna miss by a wide margin no matter how fastidious you were taking aim (crunching the numbers).

The key is to make it a point to REVISIT THEN UPDATE your spreadsheet annually for the next 8 years. That way you'll maintain some degree of accuracy.

Below is a time series chart that illustrates how quantified forecasts inherently become inaccurate over time:

Re: Finding the number, WAG or SWAG

Oh yeah, definitely a SWAG, Scarfinger. I'd say you're in good position as long as these numbers play out. The good part is that you've got plenty of buffer in your projections for inflation and expenses.

Things I can pick out that helped swing things to the positive side vs your initial post in the other thread on your situation:

- Your FERS pension will be a bit higher than the $18,000 a year. It's just a little, but over time it adds up to a lot. Paying yourself another $2,000 a year requires an extra $50,000 in TSP using the 4% rule.

- Your SS payment will be bigger than the numbers I was using, meaning you don't need as much in TSP to make up the difference.

- You will have a second pension of $9,600 a year. To cover that, you'd need an another $240,000 using the 4% rule.

Having the bigger pension as well as a second pension mean you can risk having a TSP portfolio that's almost $300,000 less than you would otherwise need. Add in the difference from a higher SS estimate, and the fact that you're aiming for 80% replacement instead of 100%, and you've given yourself lots of flexibility and "worst case" buffer. From what I can tell, you've anticipated the "shotgun spread" effect that bloobs just mentioned, but he's right - costs and "known" factors will change little by little over time, so a revisit will always be needed. I re-calculate my numbers every year over the holidays..

For planning purposes I prefer looking at the numbers I am more likely to need based on solid figures rather than a general estimate based on "multiply your salary by X". That's why I asked the question in the other thread.

Things I can pick out that helped swing things to the positive side vs your initial post in the other thread on your situation:

- Your FERS pension will be a bit higher than the $18,000 a year. It's just a little, but over time it adds up to a lot. Paying yourself another $2,000 a year requires an extra $50,000 in TSP using the 4% rule.

- Your SS payment will be bigger than the numbers I was using, meaning you don't need as much in TSP to make up the difference.

- You will have a second pension of $9,600 a year. To cover that, you'd need an another $240,000 using the 4% rule.

Having the bigger pension as well as a second pension mean you can risk having a TSP portfolio that's almost $300,000 less than you would otherwise need. Add in the difference from a higher SS estimate, and the fact that you're aiming for 80% replacement instead of 100%, and you've given yourself lots of flexibility and "worst case" buffer. From what I can tell, you've anticipated the "shotgun spread" effect that bloobs just mentioned, but he's right - costs and "known" factors will change little by little over time, so a revisit will always be needed. I re-calculate my numbers every year over the holidays..

For planning purposes I prefer looking at the numbers I am more likely to need based on solid figures rather than a general estimate based on "multiply your salary by X". That's why I asked the question in the other thread.

Seasonal Musings 2022: viewtopic.php?f=14&t=19005

Recommended Reading: http://tspcenter.com/forums/viewtopic.php?f=14&t=13474

Support the site by purchasing a membership at TSPCalc! https://tspcalc.com

Recommended Reading: http://tspcenter.com/forums/viewtopic.php?f=14&t=13474

Support the site by purchasing a membership at TSPCalc! https://tspcalc.com

- Scarfinger

- Posts: 811

- Joined: Mon Jan 30, 2012 12:00 am

Re: Finding the number, WAG or SWAG

You really got me thinking. I should have more SWAG than WAG.Aitrus wrote: ↑Sat Dec 16, 2023 10:39 am Oh yeah, definitely a SWAG, Scarfinger.

For planning purposes I prefer looking at the numbers I am more likely to need based on solid figures rather than a general estimate based on "multiply your salary by X". That's why I asked the question in the other thread.

Thanks Aitrus

I am just an average Joe. I have no clue to what the market will do.

Paul Merriman 2 fund strat: (age - 25) x2.5 = TDF + balance into S fund or variation ofTimboSlice wrote: "People really need to stop overthinking this."

Re: Finding the number, WAG or SWAG

So I was in the same boat as everyone else trying to figure out my retirement numbers and when I can/should retire. I used this site, Dan Jamison's website and FERS Guide, and Chris Barfields website mostly as it was Feds giving Feds advice. I went to a couple of retirement seminars over my career and really never learned anything I had not already learned before, mainly from the FERS Guide. The retirement calculator that used to be on Dan's site is the best one I ever used. I had received the 2023 version from a co-worker who had tracked it down after it it was no longer on Dan's site. I also used my agencies' HR retirement calculator which was not as in depth but the final numbers were very close.

I just retired at the end of September after 20.75 years as a Special Category Employee which mandates retirement at age 57. I went out on my terms and retired a month before I hit 57 as it worked better for me. I have just over 1 mil in TSP and shooting for 1.2 before I think about drawing from it. As a Special Category, I get a SS supplement until age 62 which is around $1,000 a month and my annuity after taxes and insurance should be around $5,300 a month including the SS supplement. I thought might be to low, especially compared to co-workers who had over 30 years in.

I was always aiming to have around 80% of pre retirement income available in retirement(and still want that), but learned I really do not need that much. I had also been maxing my TSP contributions since my third year as a fed which took a significant chunk of my salary. Using the retirement calculator and keeping the same amount of take home pay in retirement, I only need 54.1% of pre retirement income to maintain the same standard of living while retired. As we plan on doing a lot of travelling and have a bunch of hobbies, I want to increase that percentage, but that will involve drawing from TSP down the road.

I also had some cost saving measures that took effect in 2023, namely both kids had finished school, moved out, and took all their stuff with them, saving us money and space(downsizing). Prior to my last transfer, we bought our retirement home that had an attached apartment and rented out the main house saving the apartment for our use. Then we rented a house at my last duty station. Upon retirement we did not have to deal with selling a house, which made life easier. Now I will not have a mortgage or utility bills until we decide to move into the main part of our retirement home. We are free to travel around the U.S. and also visit family and friends and have been.

So far in October and November, I found that we have not spent more than $3,000 a month. December will be higher due to Christmas, but well below my annuity. I use my USAA credit card for all purchases to get cash back and track my spending rate.

This is just an example from someone who recently retired and how it is working out on a reduced income. I'm not trying to give advice on what you need to do or how much you need to retire. What you need to do is know your numbers as of today to help know what you need in retirement. My number is 54.1% of pre retirement income to maintain the same standard of living. Everything after that is gravy for me and the ability to do more things.

I just retired at the end of September after 20.75 years as a Special Category Employee which mandates retirement at age 57. I went out on my terms and retired a month before I hit 57 as it worked better for me. I have just over 1 mil in TSP and shooting for 1.2 before I think about drawing from it. As a Special Category, I get a SS supplement until age 62 which is around $1,000 a month and my annuity after taxes and insurance should be around $5,300 a month including the SS supplement. I thought might be to low, especially compared to co-workers who had over 30 years in.

I was always aiming to have around 80% of pre retirement income available in retirement(and still want that), but learned I really do not need that much. I had also been maxing my TSP contributions since my third year as a fed which took a significant chunk of my salary. Using the retirement calculator and keeping the same amount of take home pay in retirement, I only need 54.1% of pre retirement income to maintain the same standard of living while retired. As we plan on doing a lot of travelling and have a bunch of hobbies, I want to increase that percentage, but that will involve drawing from TSP down the road.

I also had some cost saving measures that took effect in 2023, namely both kids had finished school, moved out, and took all their stuff with them, saving us money and space(downsizing). Prior to my last transfer, we bought our retirement home that had an attached apartment and rented out the main house saving the apartment for our use. Then we rented a house at my last duty station. Upon retirement we did not have to deal with selling a house, which made life easier. Now I will not have a mortgage or utility bills until we decide to move into the main part of our retirement home. We are free to travel around the U.S. and also visit family and friends and have been.

So far in October and November, I found that we have not spent more than $3,000 a month. December will be higher due to Christmas, but well below my annuity. I use my USAA credit card for all purchases to get cash back and track my spending rate.

This is just an example from someone who recently retired and how it is working out on a reduced income. I'm not trying to give advice on what you need to do or how much you need to retire. What you need to do is know your numbers as of today to help know what you need in retirement. My number is 54.1% of pre retirement income to maintain the same standard of living. Everything after that is gravy for me and the ability to do more things.

- Scarfinger

- Posts: 811

- Joined: Mon Jan 30, 2012 12:00 am

Re: Finding the number, WAG or SWAG

That’s great first hand experience and I appreciate you sharing it with us.jdoma wrote: ↑Sat Dec 16, 2023 1:27 pm So I was in the same boat as everyone else trying to figure out my retirement numbers and when I can/should retire. I used this site, Dan Jamison's website and FERS Guide, and Chris Barfields website mostly as it was Feds giving Feds advice. I went to a couple of retirement seminars over my career and really never learned anything I had not already learned before, mainly from the FERS Guide.

I just retired at the end of September after 20.75 years as a Special Category Employee which mandates retirement at age 57.

I was always aiming to have around 80% of pre retirement income available in retirement(and still want that), but learned I really do not need that much.

My number is 54.1% of pre retirement income to maintain the same standard of living. Everything after that is gravy for me and the ability to do more things.

Thanks!

I am just an average Joe. I have no clue to what the market will do.

Paul Merriman 2 fund strat: (age - 25) x2.5 = TDF + balance into S fund or variation ofTimboSlice wrote: "People really need to stop overthinking this."

-

VAmanBulls

- Posts: 250

- Joined: Wed Jul 24, 2019 8:37 am

Re: Finding the number, WAG or SWAG

Really appreciate this information. I'm 7 years out on a left dogleg to final retirement approach. I have 2 still in high school so college may impact some decisions but I do have 529's for them so that should help. Academic scholarships are not looking good, ha. The good news is, I am just fine living in a tent as long as it's on a beach with a cooler of cold ones close by. Not sure the wife is onboard with that retirement plan however.

- Scarfinger

- Posts: 811

- Joined: Mon Jan 30, 2012 12:00 am

Re: Finding the number, WAG or SWAG

Here is a link to the above mentioned calculator:jdoma wrote: ↑Sat Dec 16, 2023 1:27 pm So I was in the same boat as everyone else trying to figure out my retirement numbers and when I can/should retire. I used this site, Dan Jamison's website and FERS Guide, and Chris Barfields website mostly as it was Feds giving Feds advice. I went to a couple of retirement seminars over my career and really never learned anything I had not already learned before, mainly from the FERS Guide. The retirement calculator that used to be on Dan's site is the best one I ever used. I had received the 2023 version from a co-worker who had tracked it down after it it was no longer on Dan's site. I also used my agencies' HR retirement calculator which was not as in depth but the final numbers were very close.

https://www.barfieldfinancial.com/clients

Another tool in the tool box.

I am just an average Joe. I have no clue to what the market will do.

Paul Merriman 2 fund strat: (age - 25) x2.5 = TDF + balance into S fund or variation ofTimboSlice wrote: "People really need to stop overthinking this."

Re: Finding the number, WAG or SWAG

You probably want to do what you can to lower your income if your kids will be applying for college grants, scholarships, or loans soon. Maxing out your TSP, IRA's & 529's can help on this year. If you file a joint return, your spouse's IRA's & 529's can help lower your adjusted income. There is supposed to be a new provision in the law starting next year to allow you to rollover any future unused 529 money to your personal IRA, so you don't have to worry about putting too much money in. For next year, you can max out your FSA, or increase your health or dental coverage (premium payments deducted directly from your pay is deferred from income for most Federal workers). Starting a business on side can be a great deduction, at least until it starts making money. If you have acreage, you can buy some livestock and file a sch F.VAmanBulls wrote: ↑Mon Dec 18, 2023 10:53 am Really appreciate this information. I'm 7 years out on a left dogleg to final retirement approach. I have 2 still in high school so college may impact some decisions but I do have 529's for them so that should help. Academic scholarships are not looking good, ha. The good news is, I am just fine living in a tent as long as it's on a beach with a cooler of cold ones close by. Not sure the wife is onboard with that retirement plan however.

Re: Finding the number, WAG or SWAG

To everyone, don't forget to budget enough for health. Fidelity estimates that you need at least $315k for healthcare related expenses in retirement (yes, a big chunk is covered by Medicare...but not everything). https://www.cnbc.com/select/how-much-ex ... etirement/. This article also includes a nursing home estimate, which can run close to 10k per month. I'm not trying to scare anyone, just be very careful in planning.

For myself, I'm still at least 20 years out so I've got more time to play with TSPCalc. I would suggest all that do not have much time or are in retirement, there are different strats that are less than a 5 SD that can give you close to an average CAGR of 25%. While these strats work "until they work" you can be reasonable assured that you can do well...at least in the meantime. Also, if you're in my boat (or have more years), throw yourself in an HSA (I waited too long to start that one!) and max out your personal IRAs too. Given the situation with Medicare and Social Security and the fact that certain politicians have been hoping to make them worse...I can only assume that by my retirement age it'll be less of everything (please do not start a political rant, this is for your investment planning purposes only).

For myself, I'm still at least 20 years out so I've got more time to play with TSPCalc. I would suggest all that do not have much time or are in retirement, there are different strats that are less than a 5 SD that can give you close to an average CAGR of 25%. While these strats work "until they work" you can be reasonable assured that you can do well...at least in the meantime. Also, if you're in my boat (or have more years), throw yourself in an HSA (I waited too long to start that one!) and max out your personal IRAs too. Given the situation with Medicare and Social Security and the fact that certain politicians have been hoping to make them worse...I can only assume that by my retirement age it'll be less of everything (please do not start a political rant, this is for your investment planning purposes only).

- Scarfinger

- Posts: 811

- Joined: Mon Jan 30, 2012 12:00 am

Re: Finding the number, WAG or SWAG

I am pretty healthy. No major medical issues on my Mom or Dad's side of the family. They only budget in

regards to health care that I plan on making is to take Medicare and keep my healthcare insurance from work once I retire. I don't plan on getting any LTC or nursing home insurance. I have read a few articles for and against LTC insurance.

The average nursing home stay is 14 months before death. I should have 400K in retirement accounts by end of life to pay for a nursing home if I end up needing one.

I will live in a nice nursing home if need be until the money runs out. Then get Medicaid and slum it until I die. If I died early then more money for the grandkids. If I live a long time in a nursing home, no money for grand kids.

I am just an average Joe. I have no clue to what the market will do.

Paul Merriman 2 fund strat: (age - 25) x2.5 = TDF + balance into S fund or variation ofTimboSlice wrote: "People really need to stop overthinking this."

Re: Finding the number, WAG or SWAG

I thought I was doing real well until I recently was told that I have CCL (chronic leukemia). I don't think that I have to worry about a nursing home, because I am already 90% with VA and there is a fairly new facility nearby. Otherwise, I feel perfectly fine right now and plan to be a burden on my wife & kids as long as possible.

Re: Finding the number, WAG or SWAG

Sorry to hear that! I hope you get all of your money's worth of life and get tons of VA help.jimcasada wrote: ↑Thu Dec 21, 2023 1:34 am I thought I was doing real well until I recently was told that I have CCL (chronic leukemia). I don't think that I have to worry about a nursing home, because I am already 90% with VA and there is a fairly new facility nearby. Otherwise, I feel perfectly fine right now and plan to be a burden on my wife & kids as long as possible.

Re: Finding the number, WAG or SWAG

So plan on 50% of your post retirement income or upgrade to a Yurt.VAmanBulls wrote: ↑Mon Dec 18, 2023 10:53 am Really appreciate this information. I'm 7 years out on a left dogleg to final retirement approach. I have 2 still in high school so college may impact some decisions but I do have 529's for them so that should help. Academic scholarships are not looking good, ha. The good news is, I am just fine living in a tent as long as it's on a beach with a cooler of cold ones close by. Not sure the wife is onboard with that retirement plan however.

Fund Prices2024-04-26

| Fund | Price | Day | YTD |

| G | $18.21 | 0.01% | 1.36% |

| F | $18.63 | 0.27% | -3.10% |

| C | $79.85 | 1.02% | 7.38% |

| S | $78.29 | 0.78% | 1.55% |

| I | $41.48 | 0.50% | 3.22% |

| L2065 | $15.89 | 0.80% | 5.08% |

| L2060 | $15.89 | 0.80% | 5.08% |

| L2055 | $15.89 | 0.80% | 5.08% |

| L2050 | $31.87 | 0.68% | 4.13% |

| L2045 | $14.54 | 0.64% | 3.94% |

| L2040 | $53.14 | 0.60% | 3.78% |

| L2035 | $14.04 | 0.55% | 3.58% |

| L2030 | $46.78 | 0.50% | 3.41% |

| L2025 | $13.02 | 0.29% | 2.45% |

| Linc | $25.43 | 0.23% | 2.10% |