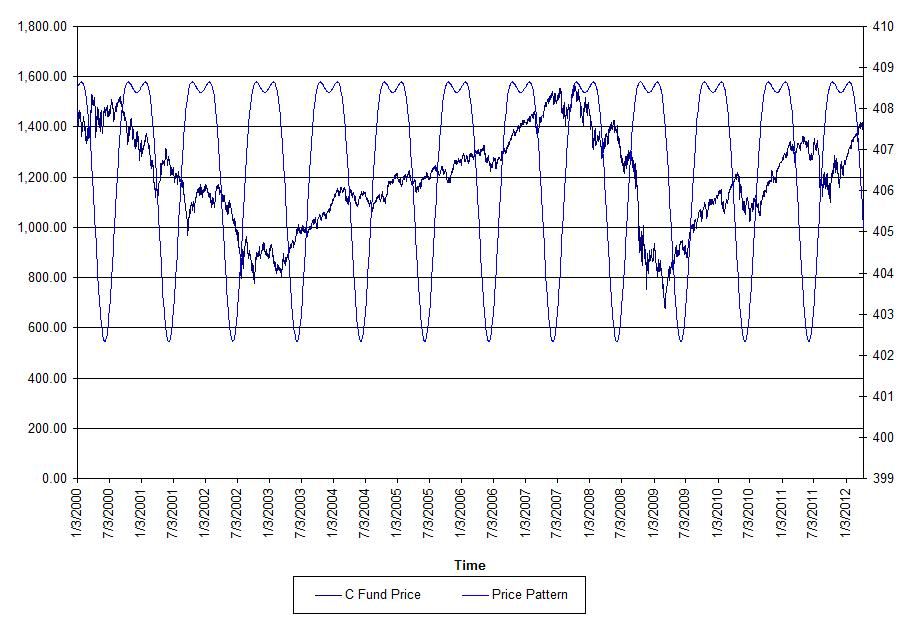

Fourier Analysis of S&P 500 Using Trigonometric Regression

Posted: Thu Apr 12, 2012 5:15 pm

This is my first analysis using spectral analysis techniques. I am posting it for informational use only.

Here is the chart:

Method:

Excel columns:

time = t= 1+ tstart

e= 2*PI()*t/365

cos(e)

sin(e)

cos(2e)

sin(2e)

Regression (Price Pattern) = Intercept+X Variable 1*COS(2*PI()*t/365)+X Variable 2*COS(2*PI()*t/365)+X Variable 3*COS(4*PI()*t/365)+X Variable 4*COS(4*PI()*t/365)

Used regression analysis to obtain coefficients:

Coefficients

Intercept 406.5036175

X Variable 1 0.603012855

X Variable 2 2.426697184

X Variable 3 0.664379511

X Variable 4 -1.801693773

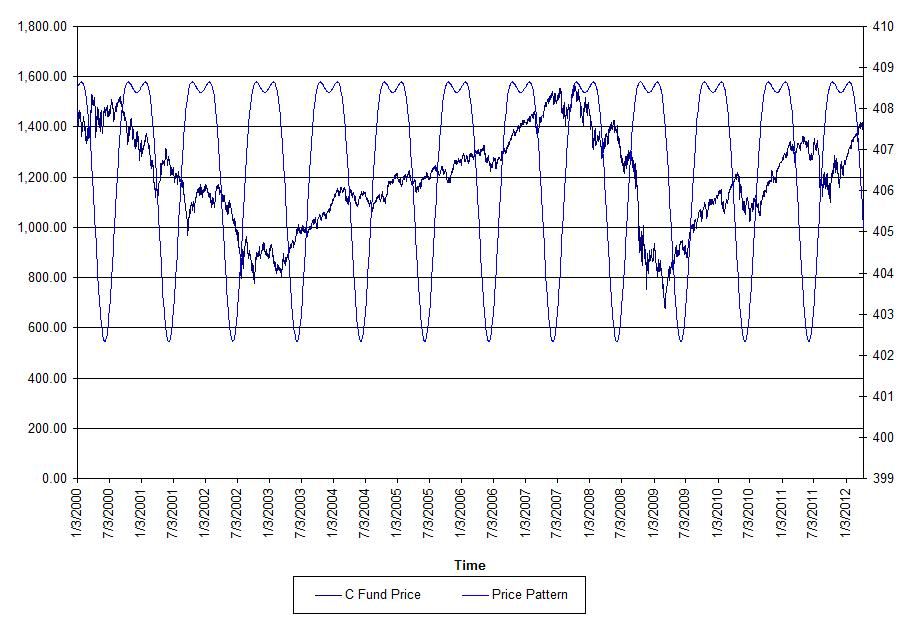

Here is the chart:

Method:

Excel columns:

time = t= 1+ tstart

e= 2*PI()*t/365

cos(e)

sin(e)

cos(2e)

sin(2e)

Regression (Price Pattern) = Intercept+X Variable 1*COS(2*PI()*t/365)+X Variable 2*COS(2*PI()*t/365)+X Variable 3*COS(4*PI()*t/365)+X Variable 4*COS(4*PI()*t/365)

Used regression analysis to obtain coefficients:

Coefficients

Intercept 406.5036175

X Variable 1 0.603012855

X Variable 2 2.426697184

X Variable 3 0.664379511

X Variable 4 -1.801693773