What is the deal man?

Moderator: Aitrus

-

VAmanBulls

- Posts: 250

- Joined: Wed Jul 24, 2019 8:37 am

What is the deal man?

So frustrating when small caps is busting out, S&P strong all day and with 30 minutes left, all the gains wiped out. I can't find the leak. Mortgage applications soar, the Fed is pumping money still, CPI looked good, some good earnings reports today and finally ink on the China deal. What the heck?

Ok, just looked and we had a positive finish, but I still hate that late day sell-off stuff. Not cool.

Ok, just looked and we had a positive finish, but I still hate that late day sell-off stuff. Not cool.

Re: What is the deal man?

CNBC implies that it's the trade deal stuff...VAmanBulls wrote:So frustrating when small caps is busting out, S&P strong all day and with 30 minutes left, all the gains wiped out. I can't find the leak. Mortgage applications soar, the Fed is pumping money still, CPI looked good, some good earnings reports today and finally ink on the China deal. What the heck?

Stocks touch record highs before giving up most of those gains into the close

https://www.cnbc.com/2020/01/15/dow-fut ... esday.html

"In the land of idiots, the moron is King."

-

crondanet5

- Posts: 4330

- Joined: Tue Aug 19, 2008 8:51 pm

Re: What is the deal man?

The last half hour is when the real investors trade. It goes into afterhours before stock prices settle. Never count your chickens until the markets settle.

another point of information is this is an options expiration week. Prices move erratically.

another point of information is this is an options expiration week. Prices move erratically.

Re: What is the deal man?

Stocks went up with anticipation of the trade deal being signed, once it is signed people "sell the event".

Re: What is the deal man?

Yup, phase 1 trade deal (FWIW) and big bank earning expectations realized in the past 2 days were, as they say, "priced in" during the last couple weeks' action--in order to "sell the news". Standard institutional practice.searight wrote:Stocks went up with anticipation of the trade deal being signed, once it is signed people "sell the event".

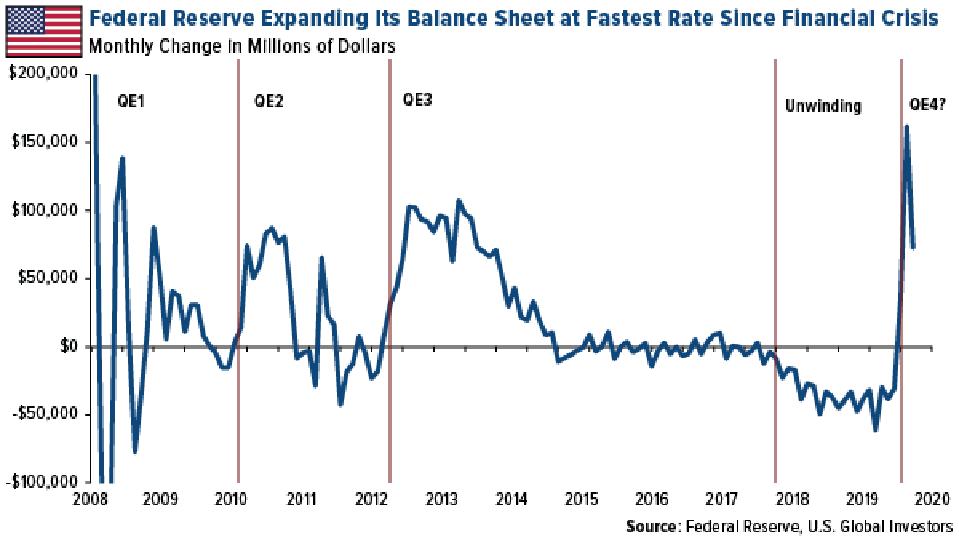

What isn't standard is the 4 months and counting quantitative easing of over $600 Billion--that is the THE major factor as to why the C Fund (based on the S&P 500 Index) has melted up since September.

Anger and intolerance are the enemies of correct understanding.

― Mahatma Gandhi

If it's a choice between a difficult truth and a simple lie, people will take the lie every time. Even if it kills them.

― Paul Murray

― Mahatma Gandhi

If it's a choice between a difficult truth and a simple lie, people will take the lie every time. Even if it kills them.

― Paul Murray

Re: What is the deal man?

IWM and DJT not at all time highs..... looking for a top

Re: What is the deal man?

TSP Jedi wrote:IWM and DJT not at all time highs..... looking for a top

DO PLEASE LET US KNOW WHEN THOSE THRESHOLDS ARE MET. TIA

Anger and intolerance are the enemies of correct understanding.

― Mahatma Gandhi

If it's a choice between a difficult truth and a simple lie, people will take the lie every time. Even if it kills them.

― Paul Murray

― Mahatma Gandhi

If it's a choice between a difficult truth and a simple lie, people will take the lie every time. Even if it kills them.

― Paul Murray

-

Optimus187

- Posts: 121

- Joined: Fri Jul 07, 2017 12:22 pm

Re: What is the deal man?

Shiekhs and 1%ers take winnings and do it all over again the next day. Just the way of the worldVAmanBulls wrote:So frustrating when small caps is busting out, S&P strong all day and with 30 minutes left, all the gains wiped out. I can't find the leak. Mortgage applications soar, the Fed is pumping money still, CPI looked good, some good earnings reports today and finally ink on the China deal. What the heck?

Ok, just looked and we had a positive finish, but I still hate that late day sell-off stuff. Not cool.

-

VAmanBulls

- Posts: 250

- Joined: Wed Jul 24, 2019 8:37 am

Re: What is the deal man?

I am glad the stock market gods heard my objections yesterday and did not sell-off today. Wow, what a gain in the S fund today. I am second guessing my split S/C decision this month.

-

seawatcher

- Posts: 99

- Joined: Sat Feb 03, 2018 10:49 pm

Re: What is the deal man?

Everyone in stocks now? 50% C and 50% S with no more IFTs (except G) Is there any data we can consider about how long this will last? Sooner or later I know the stock funds will come down. I'll keep taking the gains for now but on the edge of my seat every day at 11:50am.

What goes up must come down

Spinnin' wheel got to go 'round

Talkin' 'bout your troubles it's a cryin' sin

Ride a painted pony let the spinnin' wheel spin

What goes up must come down

Spinnin' wheel got to go 'round

Talkin' 'bout your troubles it's a cryin' sin

Ride a painted pony let the spinnin' wheel spin

Good luck with your TSP and retirement plans!

-

VAmanBulls

- Posts: 250

- Joined: Wed Jul 24, 2019 8:37 am

Re: What is the deal man?

I'm a big earnings guy. Earnings have been up since 09 and the market too has been up since 09. This is earnings season and next week is a big report-out week. Keep in mind last year's tax cuts make year to year comparisons a bit difficult. This week was more financials reporting which are not a great indicator for me due to market conditions not being favorable for banks. I don't see any indication of a recession or bear market in the near future. You always run the risk of a fear sell-off but they usually recover quickly as compared to an 08 bear event. I'm a little concerned with an overheated market. We went from S&P 3100 to 3325 pretty quick. I don't like selling on a Friday close as you tend to see folks not wanting to be long over the weekend and a late push down in the afternoon. I might look to get off the ride next Tue or Wed if we are in the green and look to buy a dip in early Feb. BTW, I really have no idea what I'm talking about but it helps me put the thoughts in my head on paper here. So 'let that shine within your mind' man and have a good weekend.

Re: What is the deal man?

My non-expert action plan (within the next 2 weeks.) is to begin reducing C (just completed its QE fun run), maintain S (still somewhat rising due to trickle down effect from C), increase I & F when it dips (relatively undervalued).seawatcher wrote:Everyone in stocks now? 50% C and 50% S with no more IFTs (except G) Is there any data we can consider about how long this will last? Sooner or later I know the stock funds will come down. I'll keep taking the gains for now but on the edge of my seat every day at 11:50am.

What goes up must come down

Spinnin' wheel got to go 'round

Talkin' 'bout your troubles it's a cryin' sin

Ride a painted pony let the spinnin' wheel spin

If you hold non-TSP accounts, make sure your equity funds have stop loss orders loaded.

Anger and intolerance are the enemies of correct understanding.

― Mahatma Gandhi

If it's a choice between a difficult truth and a simple lie, people will take the lie every time. Even if it kills them.

― Paul Murray

― Mahatma Gandhi

If it's a choice between a difficult truth and a simple lie, people will take the lie every time. Even if it kills them.

― Paul Murray

Fund Prices2024-04-15

| Fund | Price | Day | YTD |

| G | $18.18 | 0.04% | 1.23% |

| F | $18.64 | -0.61% | -3.02% |

| C | $79.24 | -1.20% | 6.56% |

| S | $77.27 | -1.66% | 0.23% |

| I | $41.14 | -0.29% | 2.38% |

| L2065 | $15.75 | -0.94% | 4.19% |

| L2060 | $15.75 | -0.94% | 4.19% |

| L2055 | $15.76 | -0.94% | 4.19% |

| L2050 | $31.64 | -0.81% | 3.38% |

| L2045 | $14.44 | -0.76% | 3.24% |

| L2040 | $52.80 | -0.71% | 3.11% |

| L2035 | $13.96 | -0.65% | 2.96% |

| L2030 | $46.52 | -0.59% | 2.83% |

| L2025 | $12.97 | -0.32% | 2.08% |

| Linc | $25.35 | -0.25% | 1.78% |